Everything You Need to Know About Loan Interest Rates & Repayment

Complete Guide to Loan Interest Rates & Repayment for Beginners

Are you considering taking out a loan but feel overwhelmed by the intricacies of interest rates and repayment plans? Understanding these aspects is crucial for responsible borrowing and achieving financial stability. Let’s demystify loan interest rates and repayment strategies to empower you with the knowledge you need.

Understanding the Concept

What is Everything You Need to Know About Loan Interest Rates & Repayment?

Imagine you're renting money, just like renting an apartment. The "rent" you pay on the money is the interest rate. Loan repayment is the process of paying back the money you borrowed, plus that interest, over a set period. Understanding these two concepts is the bedrock of responsible borrowing.

Why does understanding loan interest rates and repayment matter? Because they directly affect the total cost of the loan and your ability to manage your finances. Ignoring these factors can lead to financial strain, debt accumulation, and a poor credit score.

Loans are a fundamental part of the financial landscape, enabling individuals and businesses to achieve goals that might otherwise be unattainable. Whether it's purchasing a home, funding education, starting a business, or covering unexpected expenses, loans provide the necessary capital. Loan interest rates are the cost of borrowing this capital and represent the lender's compensation for the risk they undertake. Repayment terms dictate the schedule and manner in which the borrowed funds are returned to the lender. The loan interest rates and repayment terms are key aspects of any loan agreement.

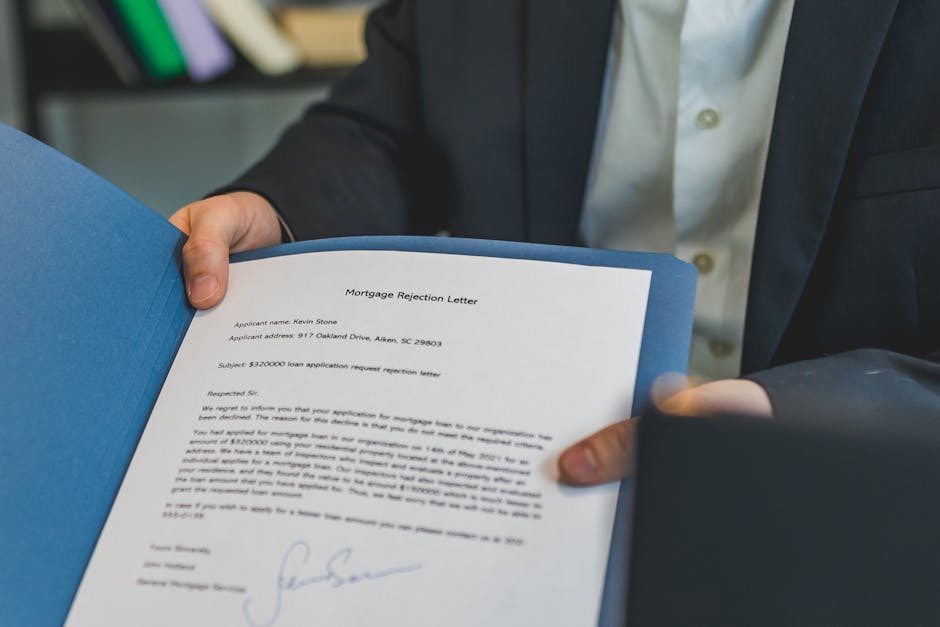

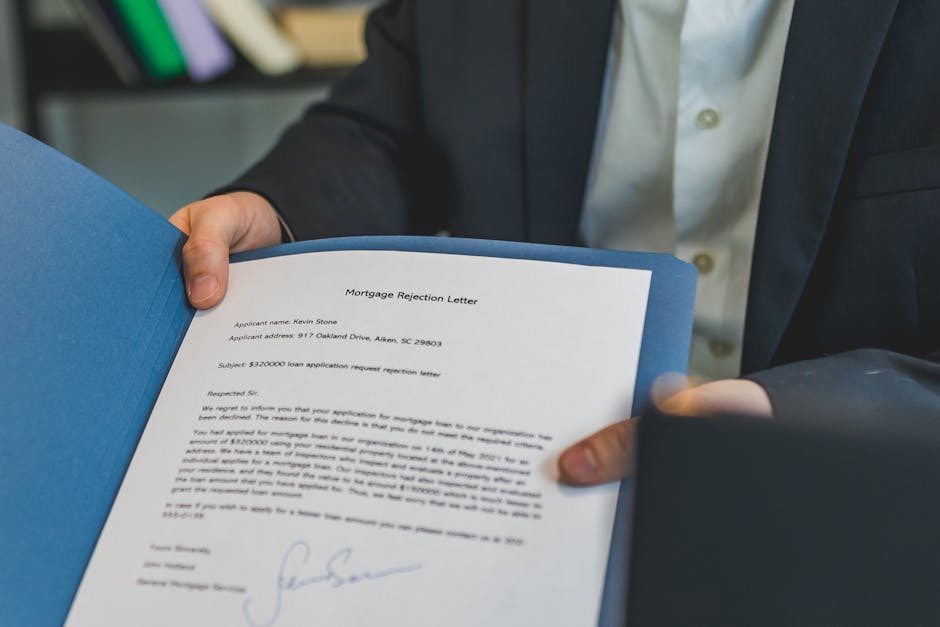

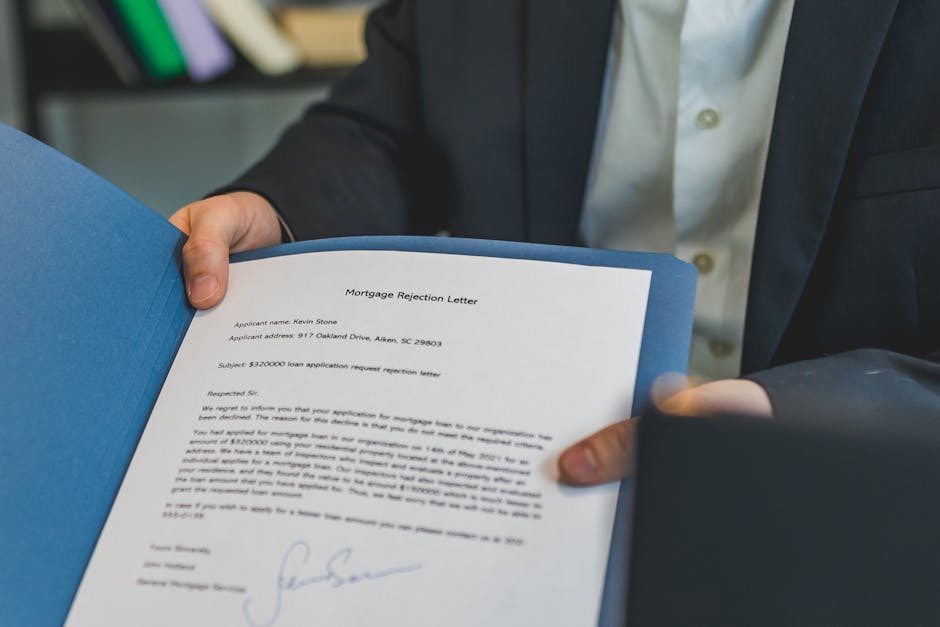

Real-world scenarios include a young couple taking out a mortgage to buy their first home, a student securing a student loan to pay for tuition, or a small business owner obtaining a loan to expand their operations. In each case, a clear understanding of the interest rates and repayment terms is paramount for making informed decisions and ensuring the loan remains manageable throughout its duration.

Benefits and Risks

Why Consider Everything You Need to Know About Loan Interest Rates & Repayment?

Understanding loan interest rates enables you to compare loan offers effectively. A lower interest rate translates to lower monthly payments and less overall interest paid over the life of the loan. Grasping repayment options lets you choose a plan that fits your budget and financial goals. This prevents undue stress and ensures the loan aligns with your long-term financial health.

Effective management of loan interest rates and repayments is particularly useful when consolidating existing debts. By understanding different rates, a borrower can consolidate high-interest debt into a single loan with a lower interest rate, thereby saving money and simplifying their repayment process. Also, when financing a significant asset like a house or a car, understanding loan terms ensures the monthly repayments are sustainable without disrupting their household finances.

Consider a small business owner seeking a $50,000 loan to purchase new equipment. By carefully evaluating loan interest rates from various lenders and negotiating favorable repayment terms, they can minimize the cost of borrowing and improve their business's cash flow. Similarly, a graduate struggling with multiple student loans can benefit from consolidating these debts into a single loan with a manageable repayment plan based on understanding various loan structures.

Potential Risks of Everything You Need to Know About Loan Interest Rates & Repayment

One of the most significant pitfalls is failing to read the fine print and not fully understanding the loan agreement. Hidden fees, prepayment penalties, or variable interest rates that can spike unexpectedly can significantly increase the total cost of the loan. Another risk is borrowing more than you can realistically afford to repay. This can lead to missed payments, late fees, and damage to your credit score.

To mitigate these risks, always thoroughly review the loan agreement, ask questions about any unclear terms, and realistically assess your ability to repay the loan. It is also advisable to compare loan offers from multiple lenders to secure the best possible terms. Finally, building an emergency fund can help cushion against unforeseen financial setbacks that might impact your ability to make loan payments.

Different loan terms significantly impact risk. For instance, a shorter loan term typically results in higher monthly payments but lower overall interest paid, reducing the risk of long-term financial burden. Conversely, a longer loan term lowers monthly payments but increases the total interest paid, potentially trapping you in debt for an extended period. Variable interest rates introduce uncertainty, as repayments can increase if rates rise, while fixed interest rates offer predictability.

Application Process

How to Apply for Everything You Need to Know About Loan Interest Rates & Repayment

The loan application process typically involves several key steps:

1. Research and compare lenders: Explore different banks, credit unions, and online lenders to find the best interest rates and terms for your needs.

2. Gather required documents: Prepare documents like proof of income (pay stubs, tax returns), bank statements, identification, and any collateral information (if applicable).

3. Complete the application form: Fill out the application accurately and honestly. Provide all requested information and double-check for errors.

4. Submit the application: Submit your completed application along with the required documents to the lender.

5. Await approval: The lender will review your application and assess your creditworthiness. This process may take a few hours to several weeks.

6. Review and accept the loan agreement: If approved, carefully review the loan agreement, including the interest rate, repayment terms, fees, and any other conditions. If you agree, sign the agreement and finalize the loan.

Eligibility factors include your credit score, income level, debt-to-income ratio, employment history, and the type of loan you're applying for. Lenders typically prefer applicants with a good credit score, stable income, and a low debt-to-income ratio, as these factors indicate a lower risk of default.

Common mistakes applicants make include providing inaccurate information, failing to compare multiple loan offers, and not fully understanding the loan terms. To avoid these mistakes, be honest and thorough in your application, shop around for the best rates, and don't hesitate to ask questions about anything you don't understand.

Interest Rates and Repayment

How Loan Interest Rates are Calculated

Interest rates are the price you pay for borrowing money, expressed as a percentage of the loan amount. They can be either fixed or variable. Fixed interest rates remain constant throughout the life of the loan, providing predictability and stability. Variable interest rates, on the other hand, fluctuate based on market conditions, potentially leading to higher or lower payments over time.

Factors that impact interest rate offers include your credit score, loan amount, loan term, and the lender's risk assessment. A higher credit score generally results in a lower interest rate, as it indicates a lower risk of default. Loan amounts and terms also play a role, with larger loans and longer terms often carrying higher interest rates.

For example, consider two borrowers seeking a $10,000 personal loan. Borrower A has a credit score of 750, while Borrower B has a credit score of 620. Borrower A might receive an interest rate of 8%, while Borrower B might be offered a rate of 15% or higher. This difference in interest rates can significantly impact the total cost of the loan. The interest rates vary, depending on the interest rates on the financial market. A loan calculator can help you see just how much of a difference the interest rates will make on the repayment of the loan.

Loan Repayment Strategies

Different repayment methods include standard repayment, graduated repayment, income-driven repayment, and extended repayment. Standard repayment involves making fixed monthly payments over a set period, typically 10 years. Graduated repayment starts with lower payments that gradually increase over time. Income-driven repayment plans base your monthly payments on your income and family size. Extended repayment allows you to stretch out your payments over a longer period, typically up to 25 years.

Strategies to pay off the loan faster include making extra payments, bi-weekly payments, and refinancing to a shorter term. Making extra payments, even small ones, can significantly reduce the loan term and the total interest paid. Bi-weekly payments involve making half of your monthly payment every two weeks, which effectively results in one extra payment per year. Refinancing to a shorter term can also help you pay off the loan faster, but it will result in higher monthly payments.

Repayment flexibility affects financial stability by providing options to manage your loan payments during times of financial hardship. Some lenders offer forbearance or deferment options, which allow you to temporarily postpone or reduce your payments. However, interest may continue to accrue during these periods, increasing the total cost of the loan. Flexibility in repayment plans can significantly reduce financial stress. # Comparison with Other Loans

Everything You Need to Know About Loan Interest Rates & Repayment vs. Alternative Loan Options

Personal loans, credit card debt, and lines of credit are common alternatives to borrowing. Personal loans typically offer fixed interest rates and fixed repayment terms, making them predictable and manageable. Credit card debt, on the other hand, often comes with variable interest rates and no fixed repayment schedule, which can lead to accumulating debt and higher interest charges. Lines of credit provide flexible access to funds but may also have variable interest rates.

Key differences lie in the interest rates, repayment terms, and the purpose for which the funds can be used. Personal loans are often used for specific purposes, such as debt consolidation or home improvement, while credit cards and lines of credit can be used for a variety of expenses. Interest rates on personal loans are typically lower than those on credit cards, but higher than those on secured loans like mortgages.

A personal loan may be a better choice for a borrower who needs a fixed amount of money for a specific purpose and wants a predictable repayment schedule. Credit card debt may be suitable for short-term expenses that can be paid off quickly, but it can be expensive if the balance is carried over for an extended period.

Common Misconceptions

Myths About Everything You Need to Know About Loan Interest Rates & Repayment

1. Myth: All loans are the same. Clarification: Loans vary significantly in terms of interest rates, fees, repayment options, and eligibility requirements. It's essential to compare offers from multiple lenders to find the best fit for your needs.

2. Myth: Only people with bad credit need loans. Clarification: People with good credit can also benefit from loans, especially when used strategically to finance investments, consolidate debt, or cover large expenses.

3. Myth: Paying the minimum amount due on credit cards is a good strategy. Clarification: Paying only the minimum amount can lead to accumulating debt and higher interest charges over time. It's best to pay more than the minimum whenever possible.

4. Myth: Interest rates don't matter as long as the monthly payment is affordable. Clarification: Interest rates significantly impact the total cost of the loan. A lower interest rate can save you thousands of dollars over the life of the loan.

5. Myth: Refinancing a loan always saves money. Clarification: Refinancing can save money if you secure a lower interest rate or a shorter loan term. However, it's essential to consider any fees associated with refinancing, as they can offset the potential savings.

Many borrowers worry about the complexity of loan agreements and the potential for hidden fees. Lenders are required to disclose all terms and conditions, so it's essential to read the fine print carefully. If you have any questions or concerns, don't hesitate to ask the lender for clarification.

Loan Management Tips

How to Manage Everything You Need to Know About Loan Interest Rates & Repayment Responsibly

Effective budgeting strategies can help you avoid financial strain while repaying loans. Create a budget that allocates a specific amount for loan payments each month, and stick to it. Prioritize loan payments over non-essential expenses, and consider setting up automatic payments to avoid missing deadlines.

To maintain a good credit score while repaying, make all payments on time and in full. Avoid maxing out credit cards, and keep your credit utilization ratio low. Review your credit report regularly for any errors or discrepancies.

When managing multiple loans, prioritize paying off high-interest debt first. Consider consolidating debts into a single loan with a lower interest rate. Use a debt snowball or debt avalanche method to systematically eliminate your debt. It is essential to know your payment options and manage the loans accordingly.

Fraud Prevention

Avoiding Loan Scams and Fraud

Red flags to watch for in fraudulent loan offers include unsolicited offers, requests for upfront fees, guarantees of approval regardless of credit score, and pressure to act quickly. Legitimate lenders will never ask for upfront fees or guarantee approval without reviewing your application.

Steps to verify legitimate lenders include checking their registration with relevant regulatory agencies, reviewing their online reputation and customer reviews, and contacting the Better Business Bureau. Avoid lenders who are not transparent about their fees and terms.

It's crucial to read loan agreements carefully before signing anything. Pay attention to the interest rate, fees, repayment terms, and any other conditions. If you're unsure about anything, consult with a financial advisor or attorney.

If you fall victim to fraud, report it immediately to the Federal Trade Commission (FTC), your local law enforcement agency, and the lender (if applicable). Freeze your credit report to prevent further damage.

Future Trends

The Future of Everything You Need to Know About Loan Interest Rates & Repayment in Lending

Emerging trends in the financial industry include the rise of fintech lending solutions, the use of AI-based credit scoring, and the increasing adoption of digital platforms. Fintech lenders leverage technology to streamline the application process, offer faster approvals, and provide personalized loan options. AI-based credit scoring algorithms analyze a wider range of data to assess creditworthiness, potentially expanding access to credit for underserved populations. Digital platforms are transforming loan accessibility by providing convenient online application portals and mobile banking solutions.

These innovations are making it easier for borrowers to access credit, compare loan offers, and manage their repayments. However, it's essential to exercise caution when using new lending platforms and to ensure that they are legitimate and reputable.

Conclusion

Understanding loan interest rates and repayment strategies is vital for responsible borrowing and achieving financial well-being. By comparing loan offers, choosing a repayment plan that fits your budget, and managing your debt effectively, you can minimize the cost of borrowing and avoid financial stress.

Responsible borrowing involves making informed decisions, understanding your financial obligations, and managing your debt wisely. By following these guidelines, you can achieve your financial goals and build a secure future.

For further guidance or loan application assistance, consult with a financial advisor or contact a reputable lender.

People Also Ask About Everything You Need to Know About Loan Interest Rates & Repayment

1. What is the minimum credit score required for Everything You Need to Know About Loan Interest Rates & Repayment?

The credit score requirement for Everything You Need to Know About Loan Interest Rates & Repayment varies depending on the lender. Traditional banks may require a score of at least 650, while online lenders or credit unions may approve applicants with lower scores. Having a higher credit score often leads to better loan terms and lower interest rates.

2. How can I get a lower interest rate on Everything You Need to Know About Loan Interest Rates & Repayment?

To secure a lower interest rate on Everything You Need to Know About Loan Interest Rates & Repayment, maintain a good credit score, reduce your debt-to-income ratio, provide collateral if applicable, and compare multiple loan offers before finalizing an agreement.

3. How long does it take to get approved for Everything You Need to Know About Loan Interest Rates & Repayment?

Approval time depends on the lender. Traditional banks may take several days to weeks, while online lenders and fintech platforms can approve loans within a few hours to 24 hours.

4. Can I use Everything You Need to Know About Loan Interest Rates & Repayment for any purpose?

Some loans, like personal loans, can be used for any purpose, including debt consolidation, home improvement, or medical expenses. However, specific loans like auto loans or mortgages are restricted to particular uses.

5. What happens if I miss a payment on Everything You Need to Know About Loan Interest Rates & Repayment?

Missing a payment can result in late fees, a lower credit score, and potential legal action if the debt remains unpaid for a long period. Many lenders offer grace periods or hardship programs, so it’s essential to contact the lender if you anticipate difficulties in making payments.